By now you’ve had time to digest last month’s announcement that San Diego-based Ballast Point Brewing was sold to New York-based liquor conglomerate Constellation Brands for $1 billion.

That’s $1 billion. I’m still trying to wrap my head around this.

While some in the industry point to the sale as a shining example of the increased power and market share of the craft beer movement, it has also caused many retailers to question the actual definition of the products within their coolers. With so many microbreweries becoming swept up by large, multinational companies like Anheuser-Busch InBev, SABMiller, Heineken, and a few others, can they still be considered a craft beer?

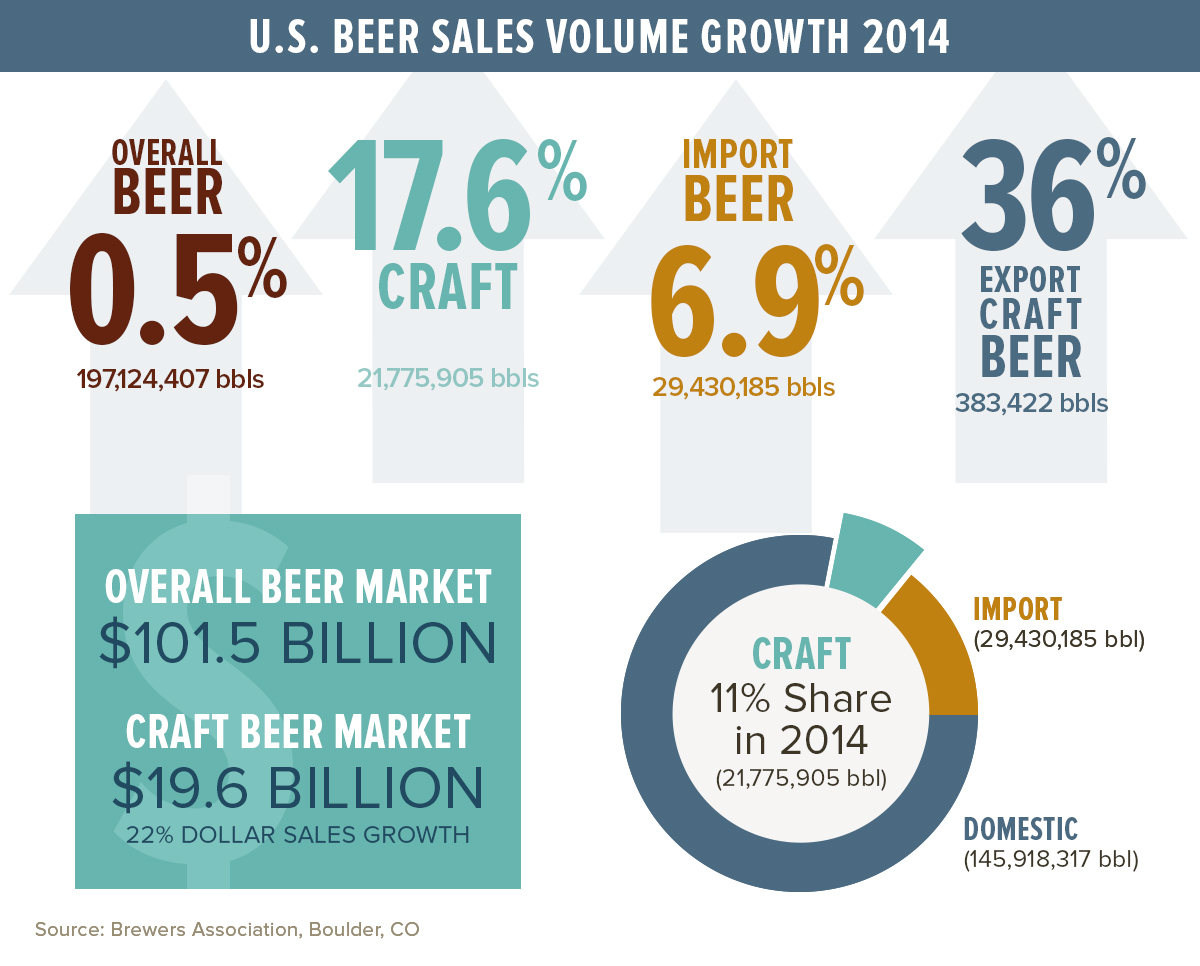

Here’s a selection of some of the microbreweries that have been purchased during the past year: Saint Archer Brewing (MillerCoors), Golden Road Brewing, 10 Barrel Brewing, Blue Point (AB InBev), Lagunitas Brewing (50-percent stake by Heineken), and of course, Ballast Point (Constellation Brands). According to the Brewers Association, craft beer sales, based on 2014 data, have increased by 17 percent, while overall worldwide beer sales have decreased by 2 percent.

[pro_ad_display_adzone id=”10118″ info_text=”ADVERTISEMENT” info_text_position=”above” font_color=”#757575″ font_size=”10″ padding=”13″]

What does that mean? Craft beer is kicking butt. And the major beer conglomerates are trying to buy their piece of the pie. It makes complete business sense.

But good business sense doesn’t translate into good beer. It is widely known that since the AB InBev merger — via hostile takeover no less — many of the old Anheuser-Busch contracts with hop and barley farmers have been cancelled in order to increase profits with international farms under contract with Belgium-based InBev. In fact, since the merger, the actual packaging of Anheuser-Busch products has weakened, an obvious attempt to reduce cost and improve the overall company bottom line.

And not only that, it leads to some interesting marketing tactics.

Take Blue Moon Brewing. Some people still consider this company a craft beer. Those people are wrong. In fact, since MillerCoors purchased the brewery, Blue Moon has tried very hard to market themselves as a microbrewery, which was what they were before they were purchased. In fact, the brewery was recently sued for using terminology and imagery that masquerades as a typical craft brewery.

And what’s worse is that some people still think Blue Moon is an actual microbrewery! What’s your alternative? How about Shock Top? Yeah, that’s owned by AB InBev.

With all of the mergers, buyouts, hostile takeovers, and general “selling out,” craft beer retailers are now facing some tough decisions. Most will never sell Budweiser, Coors Light, or Miller Lite. But should they sell Goose Island, Leinenkugel, or Peroni?

After all, those brands are owned by the major beer producers in the world — namely, Budweiser (AB InBev) and MillerCoors.

So, that brings us back to a dollar amount. That current dollar amount is $1 billion. Seriously, I can’t think of what I would not do for $1 billion. It’s kind of like a punk rock band selling out to a major record label. You can love and promote your craft for so long, but eventually you’ll want to get paid for it.

[pro_ad_display_adzone id=”10335″ info_text=”ADVERTISEMENT” info_text_position=”above” font_color=”#757575″ font_size=”10″ padding=”13″]

But beyond the brewers, what about the people who sell their products? The people who have created businesses that promote craft beer and try to educate the public about different styles of beer and the passion that has gone into the creation of these products?

Brian McBride, co-owner of Arizona Beer House, is learning this firsthand. As a longtime connoisseur and promoter of the craft beer industry, he finds himself at the crossroads of passion and commerce.

It’s not a fun place to be.

“I still carry certain package products from breweries that have sold out, but I have also cancelled tap takeovers that were scheduled before a sellout (Golden Road),” McBride said. “Goose Island Bourbon County Stout, Founders Breakfast Stout, Not Your Father’s Root Beer….they all sell really well. As a business owner it’s hard to pass up that business. I will have it on tap, carry the package goods — but don’t expect to see a tap takeover.”

It’s a fine line to walk, and as the definition of craft beer is further blurred by corporate mergers and the increased valuation of microbreweries continues, it’s a path that will become further muddied.

The overall beer market in the U.S. is approximately $101.5 billion, according to Brewers Association’s statistics from 2014, the most recent available. Of that, craft beer represents $19.6 billion, a 22 percent increase from the year prior. However, while the trajectory of craft beer sales is expected to increase, these increases will inevitably fall with the purchasing of microbreweries by major domestic conglomerates at the current rate.

[pro_ad_display_adzone id=”10139″ info_text=”ADVERTISEMENT” info_text_position=”above” font_color=”#757575″ font_size=”10″ padding=”13″]

Constellation owns the U.S. distribution rights to Corona, Pacifico, Modelo, Negra Modelo, and Victoria, as well as Svedka Vodka, Robert Mondavi Winery, Blackstone Winery, and Mark West Winery, among others. It’s purchase of Ballast Point represents its first craft beer purchase and an entry point into the fastest growing vertical in the beer market.

It more than likely won’t be the last.

David Zugerman, co-owner of Tucson Hop Shop, is now faced with an unenviable situation. As a purveyor and educator of craft beer, he must decide whether to continue selling Ballast Point products while supporting the craft beer movement.

“Ballast Point is no longer a craft brewery. “They are a large multi-national corporation brewing a high quality product,” said Zugerman. “I can understand the temptations of a smaller brewery selling to a larger organization. Craft beer is at a high point right now and in the larger beer market it is what is selling. You will always have people or companies that will want to capitalize on the sales potential.”

So what comes next? Honestly, I’m down with converting my garage into a makeshift brewery if in 20 years I can sell it for $1 billion. Hey, I love craft beer, but I love $1 billion just a little bit more.

But back in the real world, most microbreweries are not going to sell out for that much money. Actually, most won’t make it past a year or two. Some will fail because they don’t know how to market themselves. Others will fail because they just don’t know how to manage the business.

Most will fail because they don’t make good beer.

[pro_ad_display_adzone id=”10118″ info_text=”ADVERTISEMENT” info_text_position=”above” font_color=”#757575″ font_size=”10″ padding=”13″]

Yet as the increase in microbreweries continues, some see a new series of partnerships that will galvanize the craft beer industry without leading to capitulation to the major companies.

“I’d like to see a movement where smaller breweries make agreements with other little guys with the same vision,” McBride said. “Small brewers trying to work towards a common goal. I’m surprised there hasn’t been more of that (versus) craft selling to macro. There’s no common ground there, just dollars.”